The race among the world’s billionaires to maintain their wealth is as intense as ever. Figures like Elon Musk and Jeff Bezos have become household names, embodying the pinnacle of financial success in the modern age. However, as we look ahead to the end of this decade, the question arises: will they be able to keep their positions atop the wealth rankings? While it is impossible to predict the future with absolute certainty, examining current trends, potential challenges, and the evolving landscape of technology and business can provide some insights.

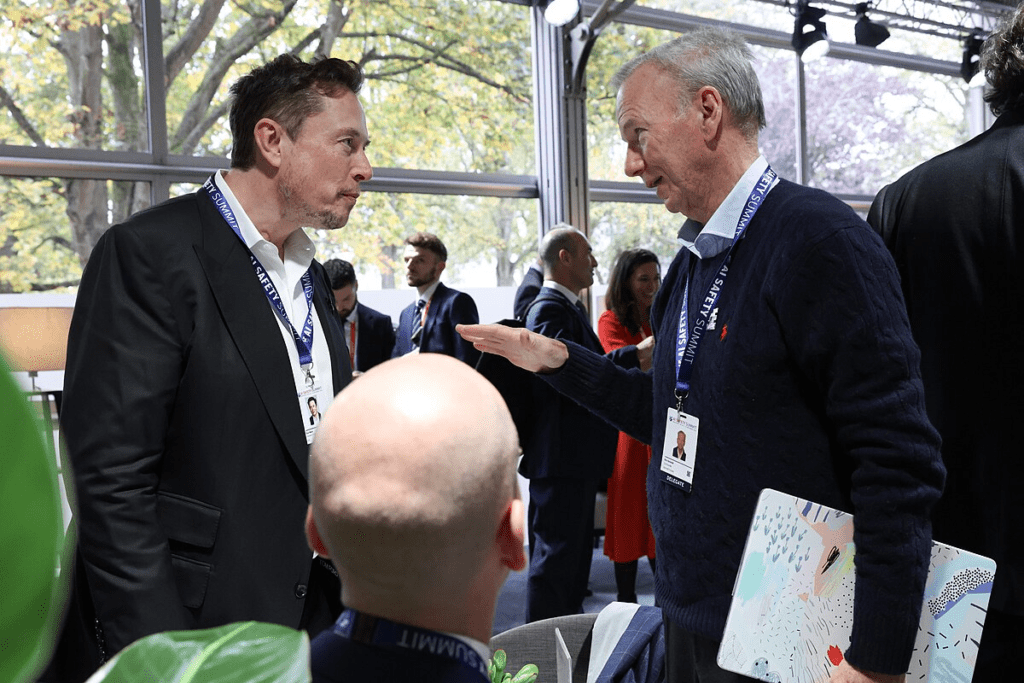

Elon Musk, the CEO of Tesla and SpaceX, has made headlines repeatedly for his ambitious ventures and controversial statements. His wealth, largely tied to the stock performance of Tesla, has seen dramatic fluctuations. Tesla’s focus on electric vehicles has positioned it at the forefront of a significant shift in the automotive industry. However, competition is heating up as traditional car manufacturers like Ford and General Motors ramp up their electric vehicle offerings. Additionally, new players like Rivian and Lucid Motors are entering the market with innovative products. Musk’s ability to stay ahead of this competition will be crucial. SpaceX also represents a major part of Musk’s portfolio. Its advances in space travel, including the successful launch of manned missions and the development of the Starship for potential Mars colonization, have been groundbreaking. However, space travel is an incredibly expensive and risky business, and any major failure or shift in public policy could significantly impact SpaceX’s valuation.

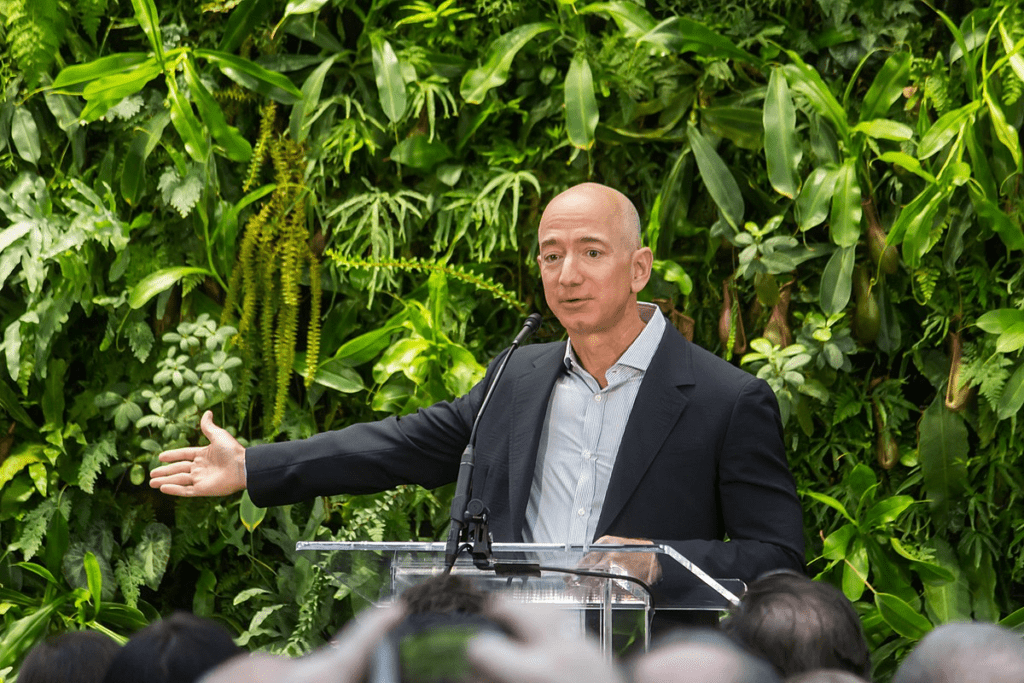

Jeff Bezos, who founded Amazon and has since moved on to focus on his space company, Blue Origin, remains one of the wealthiest individuals on the planet. Amazon’s dominance in e-commerce, cloud computing through Amazon Web Services (AWS), and its expansion into various other sectors like media and groceries have secured its place as a global juggernaut. Nevertheless, Amazon faces numerous challenges, including regulatory scrutiny, labor disputes, and increasing competition from companies like Walmart and Alibaba. Bezos’ wealth is heavily dependent on Amazon’s stock performance, which could be affected by any significant regulatory changes or economic downturns. Blue Origin, like SpaceX, is betting on the future of space tourism and colonization. However, it has lagged behind SpaceX in terms of achievements and technological advancements. For Bezos, the key will be whether Blue Origin can close this gap and establish itself as a viable competitor in the commercial space industry.

Another figure worth mentioning is Bernard Arnault, the chairman and CEO of LVMH, the world’s largest luxury goods company. Arnault has steadily climbed the wealth rankings, fueled by the enduring demand for luxury products and strategic acquisitions like Tiffany & Co. The luxury market tends to be resilient, but it is not immune to economic downturns. A global recession or significant shifts in consumer behavior could impact LVMH’s growth. Additionally, sustainability and ethical concerns are becoming increasingly important to consumers, and how LVMH addresses these issues will be crucial for its future.

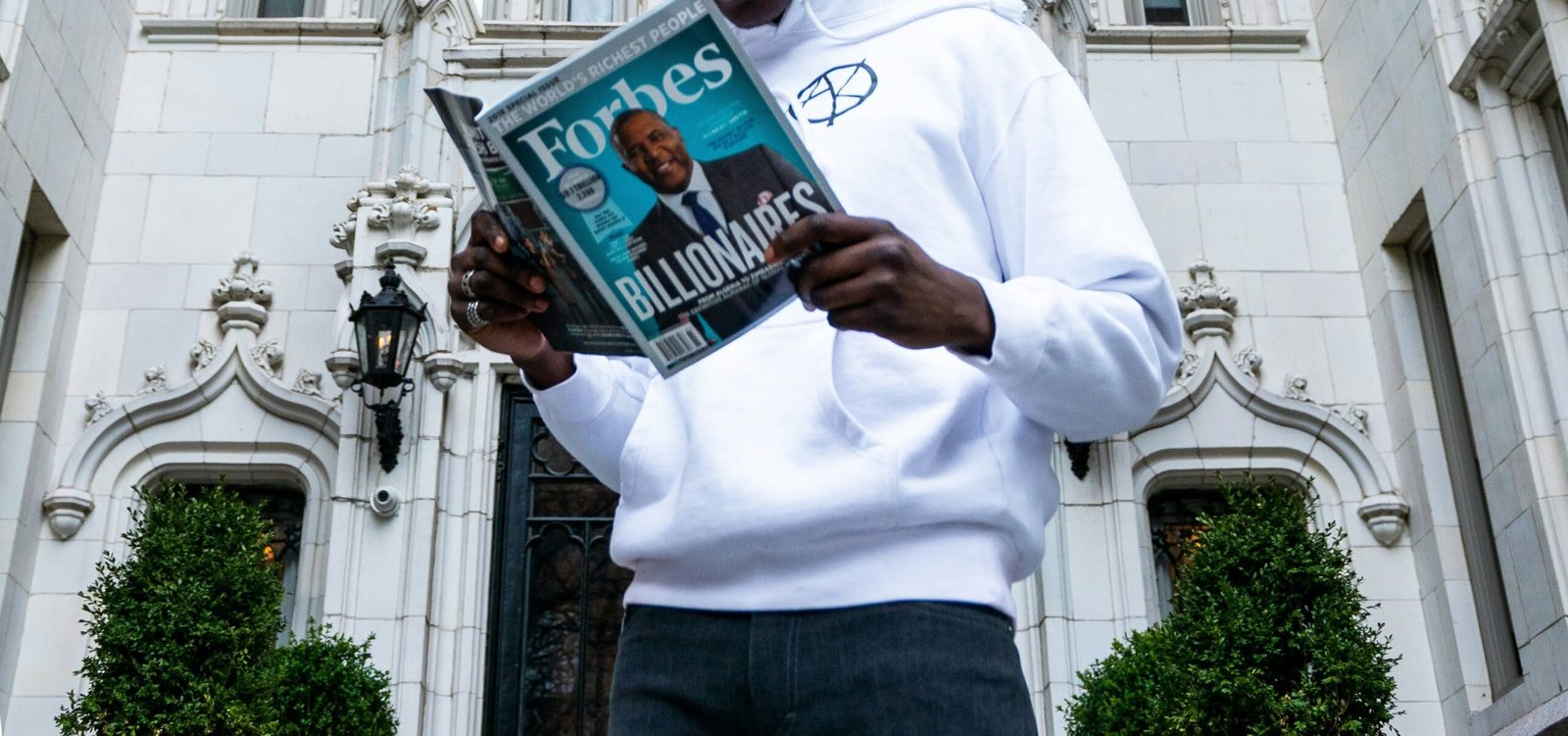

Arun Pudur, although not as widely recognized as Musk or Bezos, has made significant strides in the technology and investment sectors. His company, Celframe, has been a player in software and technology solutions. For Pudur, the challenge will be to innovate and stay relevant in a fast-evolving tech landscape where giants like Microsoft and Google dominate. Diversifying investments and adapting to new technological trends will be essential for maintaining and growing his wealth.

The broader economic landscape will also play a significant role in determining the future fortunes of these billionaires. The global economy is subject to cycles of growth and recession, and major economic disruptions, such as the COVID-19 pandemic, can have profound impacts on markets and individual wealth. Additionally, inflation, interest rates, and geopolitical tensions can influence economic stability and growth prospects. How these factors evolve over the next decade will undoubtedly affect the wealth rankings.

Technological advancements and innovations will continue to be a double-edged sword. On one hand, they present opportunities for growth and new revenue streams. On the other hand, they can disrupt existing business models and erode market shares. For instance, the rise of artificial intelligence and automation could create new industries and services, but it could also render some traditional businesses obsolete. Billionaires who can anticipate these changes and adapt their strategies accordingly will have a better chance of maintaining their wealth.

Regulation and public policy are another crucial factor. Governments around the world are increasingly scrutinizing big tech companies and billionaires for their market dominance, data privacy practices, and labor conditions. Regulatory actions, such as antitrust lawsuits or new labor laws, could impose significant costs on these companies and impact their valuations. Additionally, tax policies aimed at addressing income inequality could result in higher taxes for the wealthy, affecting their net worth.

Finally, personal decisions and legacy planning will also influence the future of these billionaires. Philanthropy, succession planning, and investment in new ventures will shape their wealth trajectories. For instance, both Bezos and Musk have committed substantial resources to space exploration, which, while promising, is also fraught with financial risks. How they balance these investments with more traditional, stable ventures will be a critical factor in their future wealth.

While Elon Musk, Jeff Bezos, and other billionaires have the potential to maintain their wealth by the end of the decade, they face numerous challenges and uncertainties. The rapidly changing technological landscape, economic cycles, regulatory pressures, and their own strategic decisions will all play pivotal roles. Those who can innovate, adapt, and navigate these complexities will be more likely to retain their positions at the top of the wealth rankings.

However, the dynamic and unpredictable nature of the global economy means that nothing is guaranteed, and even the wealthiest individuals must remain vigilant and adaptable to maintain their fortunes.