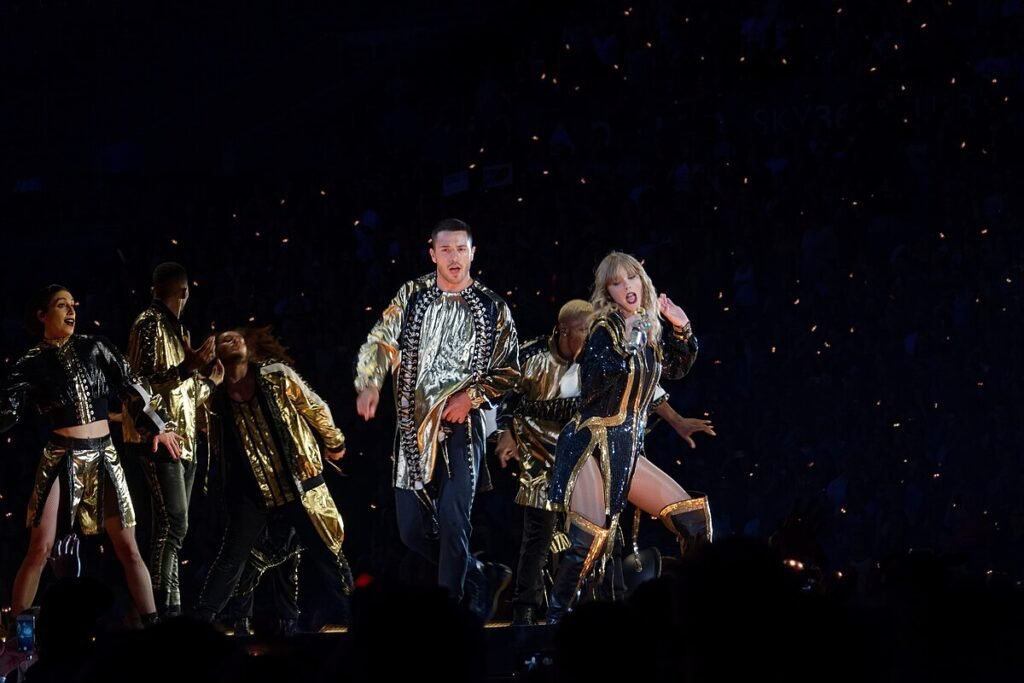

The likelihood of an August interest rate cut has diminished due to higher hotel prices, attributed by some analysts to a “Taylor Swift effect,” causing a stall in the UK’s progress against inflation.

For the second consecutive month in June, the government’s preferred measure of the cost of living remained at its 2% target.

While clothing prices fell sharply as retailers sought to clear summer stock, this was offset by the rising cost of hotel stays, according to the Office for National Statistics (ONS).

Other significant measures of price trends also showed no improvement in June. Core inflation, which excludes food, energy, alcoholic drinks, and tobacco, held steady at 3.5%, and inflation in the services sector, closely monitored by the Bank of England, remained unchanged at 5.7%.

Hotel prices rose by 8.8% annually in June compared to a modest 1.7% increase a year earlier. Analysts suggested this surge was partly due to demand around Taylor Swift’s eight UK dates during her global Eras tour.

Paul Dales of Capital Economics remarked, “Even though CPI inflation stayed exactly in line with the 2.0% target in June … it’s the stability of services inflation at 5.7% that’s the blow. And it looks as though only a small part of that may have been due to the temporary effects of Taylor Swift’s concerts. As a result, the chances of an interest rate cut in August have diminished a bit more.”

These inflation figures are the last before the Bank of England’s decision on August 1st on whether to cut interest rates, currently at 5.25%, for the first time in a year. Financial markets reduced their expectations for an August cut from a 50% to a 35% chance following the ONS data release.

Luke Bartholomew, deputy chief economist at fund manager abrdn, commented, “Today’s inflation report will keep the Bank of England’s August rate decision on a knife-edge. The strength of hotel price growth suggests a Taylor Swift effect on prices, but policymakers will almost certainly look through this kind of dynamic.”

Despite market expectations for a drop to 1.9% last month as measured by the consumer prices index (CPI), the ONS reported inflation was still at its joint lowest level in nearly three years. The annual increase in the cost of living was last lower in April 2021 at 1.5%.

Overall prices rose by 0.1% last month, matching the increase in June 2023. Food price inflation eased from 1.7% to 1.5%, while clothing and footwear prices rose by 1.6% compared to 3% in May. Hotel and restaurant inflation increased from 5.8% to 6.3%.

Rate setters on the Bank of England’s nine-member monetary policy committee expect inflation to rise to 2.5% in the second half of 2024 before falling back below the official 2% target.

Grant Fitzner, the ONS chief economist, commented, “Hotel prices rose significantly, while secondhand car costs decreased but less than last year. These increases were balanced by falling clothing prices due to widespread sales.”

Darren Jones, the chief secretary to the Treasury, stated, “It is positive that inflation is at target, but we recognize that prices remain high for families across Britain. We are dealing with the aftermath of 14 years of chaos and economic irresponsibility. This government is making tough decisions now to rebuild the foundations so that every part of Britain can prosper.”

George Dibb, associate director for economic policy at the left-leaning thinktank IPPR, remarked, “Today’s data confirms that inflation is normalizing. While some inflation drivers, like core inflation, are still high, the Bank of England’s policy stance remains overly restrictive. Interest rates have been too high for too long and need to be reduced to support growth.