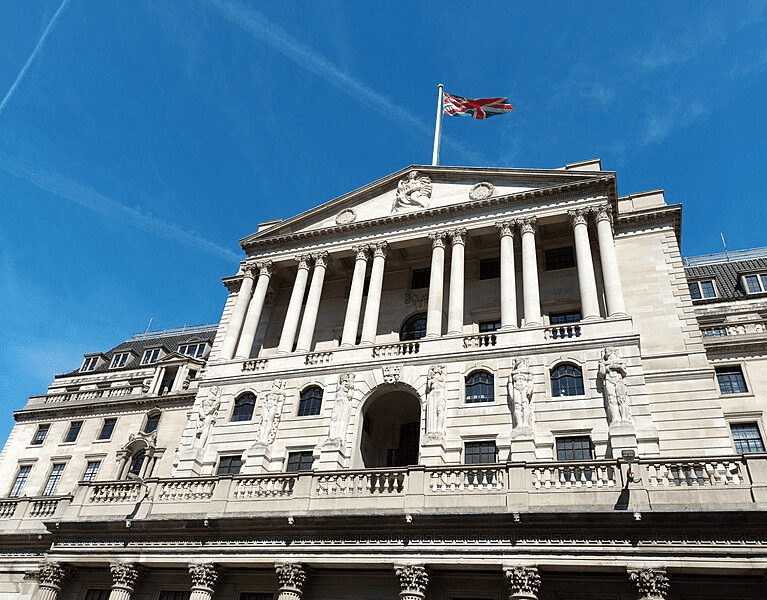

The Bank of England is expected to keep interest rates unchanged at 4.5% when the Monetary Policy Committee (MPC) announces its latest decision on Thursday.

The Bank’s rate plays a crucial role in determining borrowing costs for households, businesses, and the government, while also influencing returns for savers. The last adjustment came in February when rates were cut from 4.75% to 4.5%.

Although no immediate change is expected at this meeting, analysts predict at least two further cuts before the end of the year.

Market Reactions and Inflation Concerns

The nine-member MPC, led by Bank of England Governor Andrew Bailey, will be closely watched by financial markets. The committee meets eight times a year, and its decisions affect everything from mortgage costs to business investments.

Its primary mandate is to keep inflation at the government’s target of 2%. However, recent data shows inflation rose to 3% in January, leading many experts to believe the Bank will hold rates steady for now. Lowering rates too soon could fuel consumer spending and push inflation higher.

For homeowners, this decision may be disappointing, as mortgage rates have been gradually decreasing in anticipation of further cuts. “With inflation and economic uncertainty still lingering, homeowners hoping for additional rate relief may need to wait,” said Paul Heywood, Chief Data and Analytics Officer at Equifax UK.

Since August 2024, the MPC has implemented three rate cuts, bringing the rate to its lowest point in 18 months. However, the Bank has emphasized a “gradual and careful” approach to further reductions. While lower rates could ease borrowing costs on loans and credit cards, they may also reduce returns on savings.

Economic Outlook and Policy Implications

The UK’s economic landscape remains uncertain. In February, the Bank halved its growth forecast for 2025 from 1.5% to 0.75%, though projections for 2026 and 2027 were revised upward. Inflation is expected to climb to 3.7% before gradually declining to the 2% target by the end of 2027.

Adding to the uncertainty, Chancellor Rachel Reeves is set to deliver the Spring Statement next week, which will provide updated economic forecasts from the Office for Budget Responsibility. While major policy changes are not expected, the statement will outline government spending plans and offer insights into the broader economic strategy.