Revolution Bars will shut down 25 of its pubs and bars in one of the most significant plans to avert going to the wall. Fresh funds and operational changes are expected to buy the company time to return to firm financial health. Following the changes, it would operate 65 locations, down from 90 previously.

What Revolution Bars is doing is revolutionary as part of a comeback. Recently, the operating UK firm behind widely used pubs and bars has shown an all-new, revitalizing restructuring proposition. This proposition is supported by the crucial authors, and it has received the Court’s nod. It will be the one to lead Revolution Bars out of bankruptcy and hopefully toward the recovery stage.

Under the proposal, 25 of the company’s bars and pubs — it will close. This means they will close some of their current sites to focus the attention on the better location. With these closures, the business will have 65 sites remaining. Before these rationalisations, Revolution Bars had 90 sites under its brand namebody : Revolution Bars, Revolución de Cuba, and Peach Pubs.

Besides closing some of the chains, Revolution Bars has also raised £12.5m in emergency fundraising. The money will go a long way to help the company keep its head above water regarding its bills and make a financial comeback. It would also cut down the debts the company owes. This includes cutting down those that are eating into the company as well as reducing the rent in others so that some more might be able to get back into the black.

Revolution Bars believes these will bring significant improvement to its earnings. The company has forecasted an annual improvement of 3.8 million British pounds in its earnings before interest, tax, depreciation, and amortization. This is supposed to be a company’s main profitability measure.

It has been looking for buyers since earlier this year, but the option to restructure came out. This gave focus on the financial turnaround wrought by their reinvention rather than selling the company. However, the company has encountered issues. Current restructuring of the business negatively impacted on trading and thus its financial performance. For the year 2023, Revolution Bars reported a pre-tax loss of £22.2 million.

The company also updated its financial outlook. For the current year, it is forecasting an EBITDA of £3 million. However, this may be somewhat lower because of the disruption caused by the restructuring and the earlier sale process. As at August 8, Revolution Bars carried £23.8 million of net bank debt; this excludes lease liabilities and the funds raised under the restructuring plan.

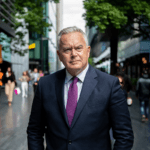

Rob Pitcher, the CEO of Revolution Bars, was relieved and hopeful of the restructuring. He said, “We are very pleased that the Court has sanctioned the restructuring plan. The group is now well diversified across the key brands, providing a more secure financial base, and we look forward to the future with improved optimism.” Pitcher also expressed his appreciation to the company’s teams for their hard work and support over this tough period.

“The CEO acknowledged that this was an extremely distressing time for everybody, not the least of all being the employees at their sites, indeed their thanks was relayed onto the organization’s backers, who consisted of their asset-based lenders, shareholders and the advisors helping to draw up the plan”.

The importance of this restructuring plan for Revolution Bars is to attain a stable business and bring vitality to its finances. It is hoped that with this closure and added funding, the company can now return to the black figures and continue serving customers with remaining sites. Maximizing the 65 they will operate and ensuring each location contributes positively toward the overall performance of the company is important.

This implies that indeed, the reorganisation does not focus on the closures but is about a strategic change in the way of doing business. Revolution Bars hopes to slope down its sourcing rents and renegotiate its loan terms, such that it can set a different course of operations that would be sustainable over the long term. All these constitute efforts to place the company towards future growth and stability.

The rescue plan will be a significant move for Revolution Bars amid the various financial troubles they are going through. In a way, it could go down to be the healthier alternative chosen for the company, which will benefit quite significantly with the cleansed way in front of them and the reset button for its core locations that the company still sees through the end of the tunnel, despite the many troubles it has been through.