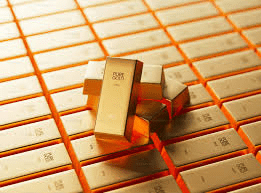

Summary: The price of gold surged to an all-time record high of $2,500 an ounce today as investors gird for an interest-rate cut by the US Federal Reserve. Prices advanced following signs that the US economy isn’t as robust as was expected, stoking possible expectations for a rate cut.

Gold has just done what it’s never done: reached a record high of $2,500 an ounce. That’s kind of a big deal, since gold is supposed to be one of the safe havens where people stick their money when other investments look dicey. Let’s dive in to understand why the price of gold is shooting up and what this really means for us.

Why Gold Prices Are Skyrocketing

The reason gold is so expensive right now has to do with some important news coming from the US Federal Reserve. The Fed is a big part of the US government that helps decide how much money costs to borrow. They, of late, have hinted at potential interest rate cuts soon. Lower interest rates often mean that people have to pay less to borrow money, which can make gold look more attractive as an investment.

The scoop is that gold prices have never been stronger, with the commodity breaking past $2,500 an ounce for the first time. This may be in part to the fear of a US Federal Reserve interest rate cut at their September meeting. The Fed has kept interest rates extremely high, which it has held for quite some time but might now turn them down to boost the economy.

Well, when interest rates climb higher, it’s pricier to borrow money. That makes gold less attractive because it doesn’t pay an interest, unlike some other investments. But when the Fed lowers interest rates, gold might shine a bit brighter. People tend to buy gold when they think the economy might be slowing down or when other investments are too risky.

The latest figures released recently showed that the construction of new homes in the US has plunged drastically. This freefall in homebuilding is much closer to what happened during the early days of the COVID-19 pandemic. This drop may be another signal that the economy is not that clean, as some may have perceived.

According to one of the members of the interest rate decision committee, Fed Bank of Chicago President Austan Goolsbee, the economy of the US isn’t overheating. Austan Goolsbee indicated that interest rates need not be continually increased if the economy is not heating up.

“You don’t want to tighten any longer than you have to. And the reason you’d want to tighten is if you’re afraid the economy is overheating, and this is not what an overheating economy looks like to me.” Goolsbee told NPR.

Stock Markets and Gold

It’s not just gold that’s seeing big changes. Global stock markets are doing well, too. Many stock indexes, including the S&P 500 and the Nasdaq 100, made huge gains. One reason is the sense that the US economy might actually avoid a recession, which is when the economy shrinks, causing people to lose their jobs.

Gold is on the road to see its best year in a very long period of time. While some argue that it can have the best year in 14 years if current trends continue, eToro market analyst Sam North sees the performance of gold as actually very impressive if this rally continues. However, there still are some risks that could impact gold’s price.

For instance, the upcoming presidential election in the US may be one such uncertainty. If ex-President Donald Trump wins the election this time again, all the apprehensions of trade wars and immigration policies will return to the system. Amidst such uncertainty, investors will seek support from gold.

Challenges Ahead

Although gold is doing well at this point, there are a few bumps ahead. For instance, if inflation—a rise in prices—quickens again, it may cause the Fed to pause in its interest-rate-cutting campaign. Also, central banks—including that of China—have also been purchasing less gold of late, which could weigh on the gold price.

Wrapping It Up

Thus, gold shines brighter than ever at a record high of $2,500 an ounce. Much of the rise is due to expectations that the US Federal Reserve will soon cut interest rates. With stock markets roaring too and gold looking safe, this is an exciting time for those who watch financial markets closely.

The key is, if you do decide to invest in gold, now may be a good time. Keep in mind that market conditions can change really fast. Be sure to watch interest rates and economic news, and anything else that might impact the price of gold.