Donald Trump’s media company, which owns Truth Social, saw its stock prices rise by 30% after news of an assassination scare. Investors believe Trump might win the upcoming presidential election, causing a rise in the overall US stock market with expectations of favorable policies like tax cuts.

On Monday, shares of Trump Media and Technology Group, the company behind Donald Trump’s Truth Social platform, surged by 30% following an incident over the weekend where Trump faced an assassination scare.

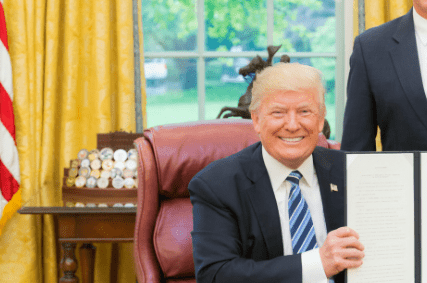

Investors showed strong support for Trump Media as it became one of the most actively traded stocks on Wall Street. Many investors seemed to believe that the weekend’s events could help Trump in his bid for a second term as President of the United States. He served as President from 2017 to 2021 and is now aiming for another term in the upcoming November election.

Market experts have labeled this trend the “Trump Trade.” This term reflects how some investors think Trump’s potential return to the White House could bring favorable policies. These could include extended tax cuts and less strict regulations for businesses, which many believe would benefit the economy.

Bob Savage, a market strategist at BNY Mellon, remarked, “The events over the weekend have many investors thinking that Trump has a better chance of winning the election.” This sentiment led to record highs for the S&P 500 and the Dow Jones Industrial Average, two key indicators of the US stock market’s performance.

Neil Wilson, a chief market analyst, also commented, “Trump was already doing well after the debate, but the weekend’s incident has made it even more likely that he will win in November.” He added, “Trump is now talking about uniting the country, which could lead to significant changes.”

Meanwhile, in the UK, the mood among investors was not as positive. The FTSE 100, a major stock market index, fell by almost 0.9%, closing at 8,182. The luxury brand Burberry experienced a significant drop of 16% in its stock value after a weak trading update, leading the company to cancel its dividend. Additionally, stocks in the mining and financial sectors also saw declines.

This event has brought a lot of attention to the US political scene and how it can impact the stock market. With Trump aiming for another term as President, investors are closely watching his moves and how they could influence economic policies.

In summary, Donald Trump’s media company saw a significant rise in its stock prices after an assassination scare over the weekend. This rise reflects investors’ hopes that Trump might win the upcoming presidential election and bring favorable policies for the economy. However, this optimism was not shared across the Atlantic, where the UK stock market experienced declines. The incident has highlighted the strong connection between political events and market reactions, showing how investors’ beliefs about potential political outcomes can drive stock market trends.