The French stock declined following the victory of the left-wing coalition, which won the highest number of parliamentary seats, causing a turmoil in the markets. The investors were actually caught by the trend of the poll results since they were anticipating a different result. The new UK finance minister, Rachel Reeves, pledged economic growth. Having influenced trading by corporate news and looming US. inflation data, European markets showed mixed responses.

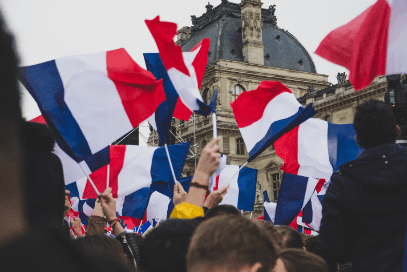

French Markets Hit by Election Surprise

The shock victory of the left-wing in parliamentary elections sent French stocks tumbling down by Monday. The key French stock market index slipped by 0.6%. During early trading hours, the performance had been excellent, while this news changed everything and the atmosphere seemed to turn upside down totally. There was no change in the common European currency, the euro, against the dollar, and bond markets were relatively calm.

Mixed Reaction Across Europe

In Europe, markets were mixed. The STOXX 600, which gauges a wide basket of European firms, hardly moved during the close of trade. In the UK, the FTSE 100 fell marginally by 0.1%. There was no change in Germany’s DAX index, while the FTSE MIB, that of Italy, increased slightly by 0.17%.

Election Outcome

The left-wing New Popular Front emerged victorious with the most seats in the parliamentary elections of France, defying expectation of gains by the far-right. However, the left-wing bloc acquired less than required seats to have total control; this situation is referred to as a “hung parliament.” It translates to no single party amassing enough power to execute decisions on its own, and it may get tricky for the government.

What Market Analysts Say

A market expert, François Digard, had earlier called a hung parliament but added that the victory of the left-wing side was a surprise. He said, “You have a hung parliament as expected. It was just expected to be more right-wing and at the end it is left-wing.”

Strategists at Deutsche Bank said the market might not have a fancy for plans by the left-wing to spend more and hike taxes. “Last night, the far-left were already talking about wealth taxes and increases in taxes on corporates, which won’t be market-friendly,” they said.

UK Election Impact

The UK has just had a general election, in which the Labour Party has come out as the winner of the election and is going to replace the Conservative Party after a long time span of 14 years. The UK’s new finance minister, Rachel Reeves, said in a speech that her party is going to boost the economy by building more homes. She said, “We are going to get Britain’s economy growing again. And there is no time to waste.”

Company News and Market Move

On Friday, the housebuilding companies’ shares climbed, while yesterday they moved with the general market. At the other end of the spectrum, the soft drinks company Britvic received a takeover offer from Carlsberg, estimated at £3.3 billion. The offer was initially less generous in terms of value, but now 1,290p a share sealed the deal.

Quiet Day for Corporate Earnings and Data

There were no major company earnings reports due out Monday, and it was also a quiet day for economic data.

Global Market Trends

On Monday, Asia-Pacific stock markets were mixed. U.S. futures dropped slightly as traders gear up for major inflation data. Scheduled for release are a consumer price index, which is a measure of changes in prices, on Thursday, and on Friday, the data on the producer price index. With these reports, investors will know how the market may move to the next level.

A view of the day’s market activities moved by astonishing political events and other financial news sums up in an article in basic, clear terms.