A deaf man, Peter James, was manipulated through a gang into casting off a £28,000 loan from Metro Bank. Despite having no property and unique needs, he changed into authorized for the loan. After intervention by Guardian Money, Metro Bank agreed to write down off the debt, however questions remain approximately their safeguards.

A deaf man named Peter James became tricked by way of a gang into removing a £28,000 commercial enterprise mortgage from Metro Bank. His family is traumatic to realize how someone with unique wishes and no large assets might be allowed to borrow one of these large sums.

Peter, who communicates simplest via British Sign Language and has special educational wishes, became almost bankrupt and pursued with the aid of the financial institution’s debt creditors before Guardian Money stepped in to assist. This case increases serious questions on how banks guard susceptible human beings from being exploited and the safeguards they’ve in location.

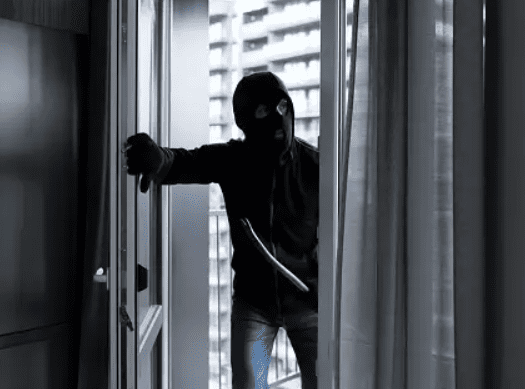

In 2020, Peter changed into taken to the Ilford department of Metro Bank in London. He became followed by way of a person who claimed to be appearing on his behalf. They opened a bank account in his name, provided his ID, and once the bureaucracy were signed, the partner took his debit card and disappeared. Later, they implemented for a business bounce back loan, which become deposited into the brand-new account.

Peter, residing in a council flat in south London along with his deaf wife, faced identification robbery problems in the course of the lockdown. His father-in-law, Steve Hall, explained that while HMRC recognized the fraudulent Covid aid furnish applications and stopped chasing Peter for repayments, Metro Bank did no longer. Despite explaining the state of affairs to the financial institution, they held Peter answerable for the loan and refused to offer records or prevent worrying compensation.

Steve Hall said getting information from Peter became difficult, however it seems he turned into groomed by means of a gang promising him paintings in a new enterprise. He changed into advised to carry his passport to a meeting, picked up in a Mercedes, and forced at hand over his telephone. He was later dropped off at a tube station, handed over his bank card in trade for his phone, and changed into instructed to keep quiet. He by no means heard from the gang once more.

The circle of relatives doesn’t understand how Metro Bank decided Peter turned into eligible for this sort of big mortgage. Despite having a steady activity, he lives in social housing with no tremendous belongings. They additionally wondered why the financial institution did no longer ask for the ID of the person who followed Peter.

After Guardian Money got concerned, Metro Bank agreed to write down off the loan, declaring that the new information found out how scammers prey on vulnerable human beings. They reminded readers to be cautious approximately sharing non-public information, establishing accounts, and being rushed or compelled into financial selections. The financial institution admitted it does now not require ID from humans accompanying clients, even for sizeable loans, that may permit such incidents to appear once more.

The circle of relatives hopes Metro Bank learns from this case. They are relieved the mortgage has been written off and might now circulate on. Steve Hall referred to that he values the Guardian’s assist, even renewing his subscription as a token of appreciation.

Peter’s tale highlights the want for higher safeguards in banks to shield vulnerable humans from scams. While the circle of relatives is relieved, they consider Metro Bank need to improve its strategies to save you similar instances inside the future.