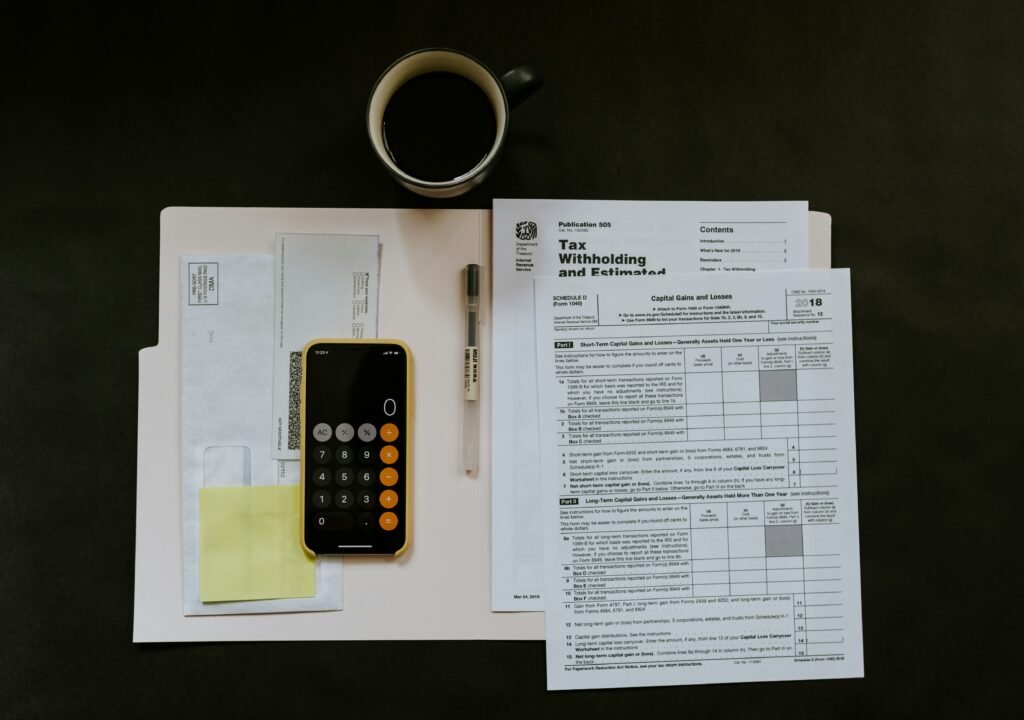

Embark on a journey through the intricate world of hedge fund taxation, where complexities abound and strategic decisions hold sway. From unraveling the tax structures to navigating regulatory landscapes, this article offers a comprehensive guide for investors and fund managers alike. Explore the nuances of tax planning, discover advanced strategies, and unlock the secrets to success in optimizing returns while minimizing tax burdens.

Exploring Taxation at the Investor Level

As investors delve into the intricate world of hedge fund taxation, it becomes imperative to understand the nuances of tax liabilities and implications. Unlike traditional investment vehicles, hedge funds present a unique landscape where tax considerations play a pivotal role in shaping investment strategies and outcomes. Additionally, if you want to know more about investments and firms, you may visit an education firms.

One of the fundamental aspects for investors is discerning between distributions and capital gains. While distributions represent periodic payouts from the fund’s profits, capital gains are realized when investments within the fund are sold for a profit. It’s essential for investors to grasp the tax implications associated with each, as they can significantly impact overall returns.

Furthermore, navigating tax-efficient strategies becomes paramount in optimizing investment outcomes. From utilizing tax-loss harvesting to structuring investments in a manner that minimizes tax liabilities, investors must employ a meticulous approach to tax planning. By leveraging various strategies, investors can potentially enhance after-tax returns and mitigate tax burdens.

However, the road to tax efficiency is fraught with complexities. Tax reporting and compliance requirements can pose significant challenges for investors, especially in the ever-evolving regulatory landscape. From filing accurate tax returns to adhering to reporting deadlines, investors must tread carefully to avoid potential pitfalls and penalties.

Demystifying Taxation from the Fund Manager’s Perspective

From the perspective of fund managers, taxation represents a multifaceted challenge that requires a strategic and proactive approach. As stewards of investor capital, fund managers bear the responsibility of optimizing tax efficiency while navigating regulatory complexities.

One of the primary considerations for fund managers is devising tax planning strategies that align with the fund’s objectives and investment philosophy. By structuring the fund in a tax-efficient manner and leveraging jurisdictional advantages, managers can potentially enhance after-tax returns for investors.

Moreover, mitigating tax risks remains a top priority for fund managers. In the heart of a dynamic regulatory landscape, staying abreast of tax laws and regulations is paramount to ensure compliance and avoid potential liabilities. Implementing robust compliance measures and conducting thorough due diligence are essential steps in safeguarding the fund’s interests.

Additionally, fund managers must carefully consider the implications of performance fee structures and compensation models on tax liabilities. By designing bespoke fee arrangements that balance investor interests with tax efficiency, managers can foster transparency and alignment of incentives.

Advanced Topics in Hedge Fund Taxation

In the ever-evolving landscape of hedge fund taxation, advanced topics offer deeper insights into emerging trends and innovative strategies. From cross-border considerations to legislative changes, staying ahead of the curve is essential for investors and fund managers alike.

Cross-border investments introduce a myriad of tax implications that necessitate careful consideration and planning. From navigating jurisdictional differences to managing foreign tax credits, investors must navigate a complex web of regulations to optimize returns. Moreover, the rise of digital assets and cryptocurrency adds another layer of complexity to cross-border taxation, requiring innovative solutions and expertise.

Legislative changes and regulatory updates further underscore the importance of staying informed and adaptive in the realm of hedge fund taxation. From tax reform initiatives to regulatory scrutiny, the landscape is constantly evolving, presenting both challenges and opportunities for stakeholders. By staying abreast of changes and engaging with policymakers, investors and fund managers can proactively shape the regulatory environment and mitigate potential risks.

Furthermore, advancements in tax technology offer promising avenues for enhancing efficiency and compliance in hedge fund taxation. From automated reporting solutions to blockchain-based platforms, technology has the potential to revolutionize tax processes and reduce administrative burdens. By embracing innovation and leveraging cutting-edge tools, stakeholders can streamline operations and unlock new possibilities in tax management.

Navigating hedge fund taxation demands a nuanced understanding and proactive approach. By embracing tax-efficient strategies and staying abreast of regulatory changes, investors and fund managers can chart a course towards enhanced returns and compliance. Remember, seeking expert advice and leveraging innovative solutions are key to thriving in the ever-evolving realm of hedge fund taxation.