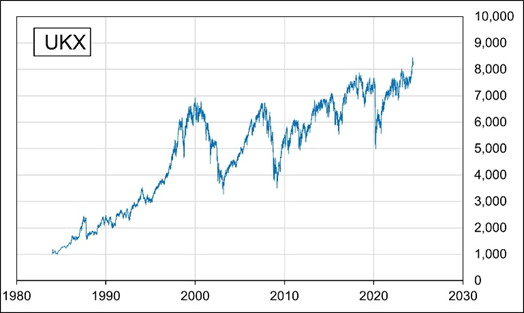

FTSE 100 Live: Equity Drops as Unexpected Retail Sales Slump: Century-Old Investment Trusts Combine

A significant union between two century-old investment trusts has led to a surprising decline in retail sales which ultimately caused the FTSE 100 to fall 27 points to 8,220.

Overview of Commodities and Currencies

An overview of today’s commodity and currency moves is provided below, as the FTSE 100 continues its downward trend into the close:

Bitcoin/USD: -0.1% at $61,720

GBP/USD: -0.3% at $1.264

GBP/EUR: -0.1% at €1.182

EUR/USD: -0.2% at $1.06

Brent Crude: +0.4% at $85.38

WTI Crude: +0.3% at $81.10

Gold: -1% at $2,297

Silver: -0.5% at $28.72

Boeing Union Seek 40% Salary Increase

Boeing’s largest union is attempting to increase pay by 40% by taking advantage of the company’s problems with its 737 Max aircraft. Representing about 32,000 workers in Seattle, the International Association of Machinists and Aerospace Workers is pushing for the local construction of the next narrow-body aircraft in order to ensure increased pay and job security.

Aston Martin Drops Information About Supercar Launch

Following the release of the £2 million Valiant model, a limited-edition petrol supercar, Aston Martin shares dropped by more than 3%. There will only be 38 5.2-liter Twin-Turbo V12 Valiants produced, all of which have already been reserved. Inspired by Formula One driver Fernando Alonso, the model was created by Aston Martin’s bespoke division to commemorate the V12 performance era.

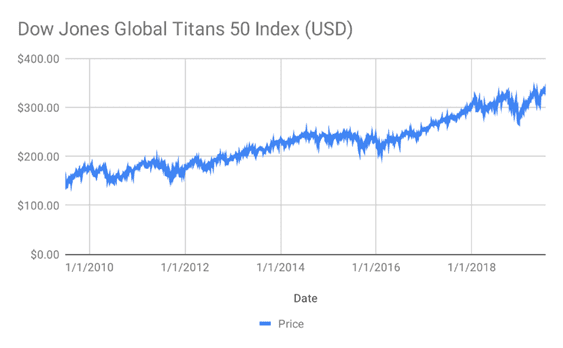

Wall Street Commences US markets began the day with a decline as investors reevaluated the AI-driven boom. The Nasdaq remained unchanged, but the Dow Jones and S&P 500 both saw 0.3% declined drastically. Following pre-market turbulence, Nvidia, a significant player in AI stocks, was surprisingly stabilized at the end. FedEx’s stock increased 12.5% in the meantime as a result of strong fiscal fourth-quarter and full-year results which gave an economic bloom to the company statistics.

Theme Park at Universal UK to Strengthen Economy

A theme park near Bedford, planned by Universal, is expected to boost the UK economy by £50 billion over the course of 30 years. The project, which is Universal’s first in Europe, is anticipated to produce a large amount of employment and tax income, with 20,000 jobs being created during construction and an additional 8,000 during the initial operating phase.

June Retail Sales Crash

CBI’s distributive trades survey indicates that retail sales volumes declined dramatically in June, falling by 24% compared to an 8% gain in May. The unanticipated decrease is blamed for an unusually low temperature and a discernible drop in internet sales. The acting deputy head economist at the CBI, Alpesh Paleja, stressed the necessity of government intervention to help companies in the face of uncertain consumer demand.

Investment Trust Merger: An estimated £5 billion will be created by the combination of Wisdom and Alliance Trusts. The FTSE 100 will soon welcome the new Alliance Witan PLC, which will ultimately provide an improved liquidity and a structural and competitive pricing structure which will help the company increase their stats. Analyst Iain Scouller of Stifel commended the merger and said it was a sensible decision for the shareholders, although he cautioned about possible volatility in share prices.

Sales of De Beers Drop

The largest diamond manufacturer in the world, De Beers, reported lower sales in its most recent cycle, with revenue down from £302 million to £250 million. Anglo American, the parent corporation is thinking of selling De Beers as part of a larger reorganization after BHP’s failed purchase attempt.

The strategic pivot of AO World

Following restructuring efforts centered on profitability, AO World had an 186% increase in annual profits. Now part of the FTSE 250, the company expects double-digit revenue growth in the upcoming year thanks to a streamlined business model that eliminated non-core projects.

Deliveroo’s Stock Increases Amid Acquisition Interest

The report of US delivery company Doordash’s possible acquisition interest caused Deliveroo’s stock to rise by 3.5%. Despite the initial breakdown of negotiations, analysts believe there is still a strong financial and strategic case for the merger, which might lead to more M&A activity in the sector.

Volkswagen and Rivian Establish Collaboration

Volkswagen has disclosed a $5 billion investment in US electric vehicle maker Rivian through a strategic joint venture, in order to obtain access to its technologies. Rivian’s shares increased 50% in pre-market trading after the news. The deal offers growth opportunities for European and domestic manufacturers at a time when tariffs are being applied by the US and EU to Chinese electric vehicle imports.

Morning Market Overview

This morning’s gains for the FTSE 100 erased Tuesday’s losses. Confidence was bolstered by the US tech boom, spearheaded by Nvidia. An announcement was made about the merging of Alliance and Witan Investment Trusts, which produced a £5 billion portfolio and a new FTSE 100 entry. Additionally, AO World revealed a significant rise in profits.

Notable company actions and economic indicators characterized today’s market activity. Unexpected drops in retail sales are putting pressure on the FTSE 100, while significant acquisitions and Strategic reversals in a number of industries indicate continuous changes to the global market environment.