The European Central Bank (ECB) has announced its first interest rate cut in five years, reducing its main rate from an all-time high of 4% to 3.75%. This decision follows Canada’s rate cut earlier in the week, making the EU the second major global economy to lower its lending rate in recent days. The move comes as the ECB reports progress in tackling inflation, coinciding with EU-wide elections that are expected to reflect public discontent over cost-of-living pressures.

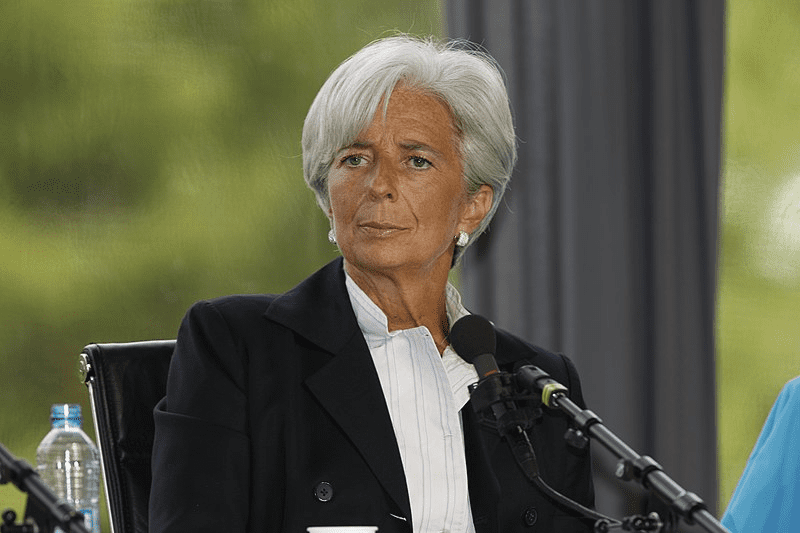

Christine Lagarde, president of the ECB, stated that the outlook for inflation had “markedly” improved, which facilitated the rate cut. However, she cautioned that inflation would likely remain above the ECB’s 2% target “well into next year,” with forecasts averaging 2.5% in 2024 and 2.2% in 2025. Lagarde emphasized that the ECB would maintain a “sufficiently restrictive” interest rate policy to achieve its 2% inflation target, adding, “We are not pre-committing to a particular rate path.”

Investment strategist Lindsay James from Quilter Investors noted that the rate cut was anticipated and would provide relief to consumers and businesses in Europe. “The ECB has stolen a march on the Bank of England and [US] Federal Reserve – who are both potentially still a few months away from cutting – and will breathe life into an economy that desperately needs some form of stimulus,” she said.

Central banks have maintained high rates over the past two years to combat rising prices, with most aiming for an annual inflation rate of 2%. Higher interest rates typically slow economic growth, so the ECB’s rate cut aims to boost economic activity by making borrowing cheaper for consumers and businesses.

The ECB’s rate-setting body met in Frankfurt and decided to cut rates despite a slight increase in inflation in May, which rose to 2.6% from 2.4% in April across the 27-nation bloc. This decision follows Canada’s rate reduction on Wednesday, which lowered its headline rate from 5% to 4.75% after inflation fell to 2.7%. Sweden and Switzerland have also recently trimmed their rates.

Lagarde provided a broader assessment of the eurozone’s economic outlook, expressing increased confidence in the future while acknowledging potential challenges. “The risks to economic growth are balanced in the near term but remain tilted to the downside over the medium term,” she said, citing geopolitical tensions in Ukraine and the Middle East, as well as climate-related issues that could affect food prices.

Katherine Neiss, chief European economist at PGIM, expressed confidence that the ECB would likely cut rates further in the coming months, potentially reducing rates to 3.5% or lower by year-end. “Growth is encouragingly recovering from the recession that the euro area went through towards the end of last year, but it’s still sluggish,” Neiss told the BBC’s Today Programme. Slowing inflation and easing wage growth would support another rate cut, she added.

In the UK, interest rates have yet to start decreasing, though there is speculation that the Bank of England might cut rates soon, possibly as early as this month. UK inflation has fallen to 2.3%, significantly down from its peak of over 11% in late 2022. The International Monetary Fund recently suggested that the Bank of England should reduce rates from their current 5.25% to 3.5% by the end of the year.

George Godber from Polar Capital commented that the upcoming UK election could influence the Bank of England’s rate decision. “If they cut it’ll be political, if they don’t cut it’ll be political,” he said, highlighting the complexities facing the central bank. Similarly, the US Federal Reserve is also expected to cut rates in the near future, with the latest US inflation figure at 3.4%. The Fed is likely to make its first move on rates before the immediate run-up to voting in November, according to Godber.